2.5 billion deal for the software-defined vehicle

Infineon acquires Marvell's automotive ethernet division

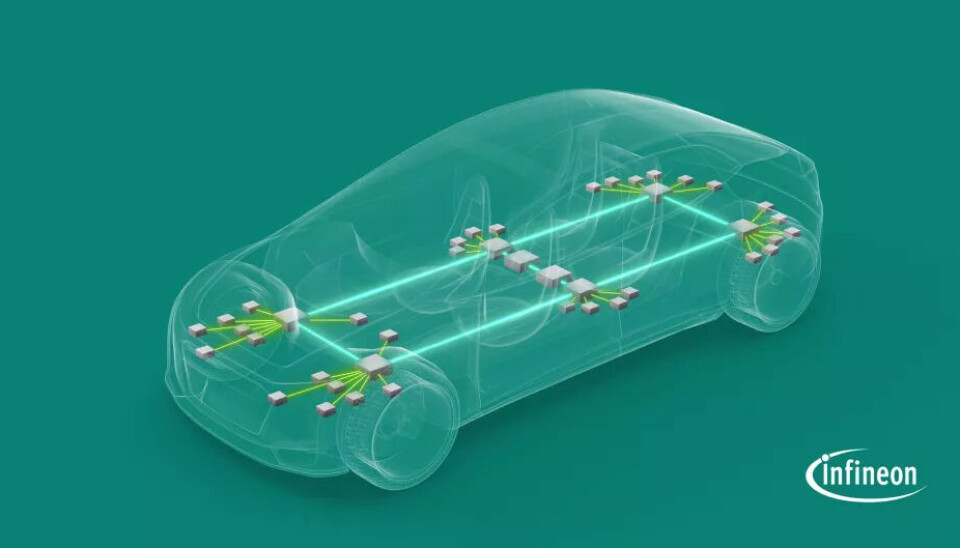

Ethernet connectivity solutions are crucial for software-defined vehicles. They form the foundation for high-performance E/E architectures consisting of central computing units, zones, and endpoints.

Infineon

With the planned acquisition of Marvell's automotive ethernet business for 2.5 billion US dollars, Infineon strengthens its position in the automotive market and focuses on pioneering connectivity solutions for software-defined vehicles.

Infineon Technologies strengthens its system competence for software-defined vehicles with the acquisition of Marvell Technology's automotive Ethernet business. This complements and further expands Infineon's microcontroller business. Infineon and Marvell have signed a contract for the transaction at a purchase price of 2.5 billion US dollars in cash. The acquisition is subject to the necessary regulatory approvals.

Ethernet is a key technology for communication and connectivity solutions with low latency and high bandwidth, which is crucial for software-defined vehicles. Furthermore, it holds great potential for adjacent application areas such as humanoid robots. The planned investment will further strengthen the already strong presence in the USA, including extensive activities in research and development.

Marvell's Brightlane automotive Ethernet portfolio of PHY transceivers, switches, and bridges supports data transfer rates from today's 100 Mbps up to 10 Gbps. It also supports the security features required for today's and future vehicle networks.

Why is Ethernet so important for the software-defined vehicle?

Ethernet connectivity solutions are crucial for software-defined vehicles. They form the foundation for highly efficient E/E architectures, consisting of central computing units, zones, and endpoints. Complex functions such as driver assistance systems, autonomous driving, and over-the-air software updates require the secure processing, networking, and storage of enormous amounts of data.

In combination with the Infineon AURIX microcontroller family, a comprehensive offering emerges that includes both communication solutions and real-time control. The acquisition aims to further strengthen Infineon's leading position as number one in the microcontroller sector.

Marvell's customer base and future potential of the acquisition for Infineon

Marvell's automotive Ethernet business customers include more than 50 car manufacturers, including eight of the top ten OEMs. The strong customer relationships are supported by a design-win pipeline of around four billion US dollars by 2030 and a strong innovation roadmap. They also pave the way for future revenue growth.

The business is expected to generate revenue between 225 and 250 million US dollars in the calendar year 2025 with a gross margin of around 60 percent - with strong potential for further growth acceleration through Infineon's unique global access to automotive customers.

Further cost synergies are expected through the consolidation of research and development activities and in the area of manufacturing. Marvell's Automotive Ethernet division comprises several hundred highly qualified and dedicated employees. Significant locations are in the USA, Germany, and Asia. Upon completion of the transaction, Marvell's Automotive Ethernet business will become part of Infineon's Automotive Division.

How will Infineon finance the acquisition of Marvell's Automotive Ethernet business?

To finance the planned acquisition of Marvell's Automotive Ethernet business in an all-cash transaction, Infineon will use existing liquid funds and additionally raise debt capital. Infineon has secured acquisition financing from banks. The transaction is subject to the usual closing conditions, including regulatory approvals, and is expected to be completed within the calendar year 2025.

This article was first published at all-electronics.de